The Significance of Understanding the Value of Risk Management in Different Industries

The Core Concept of Risk Management and Its Objective

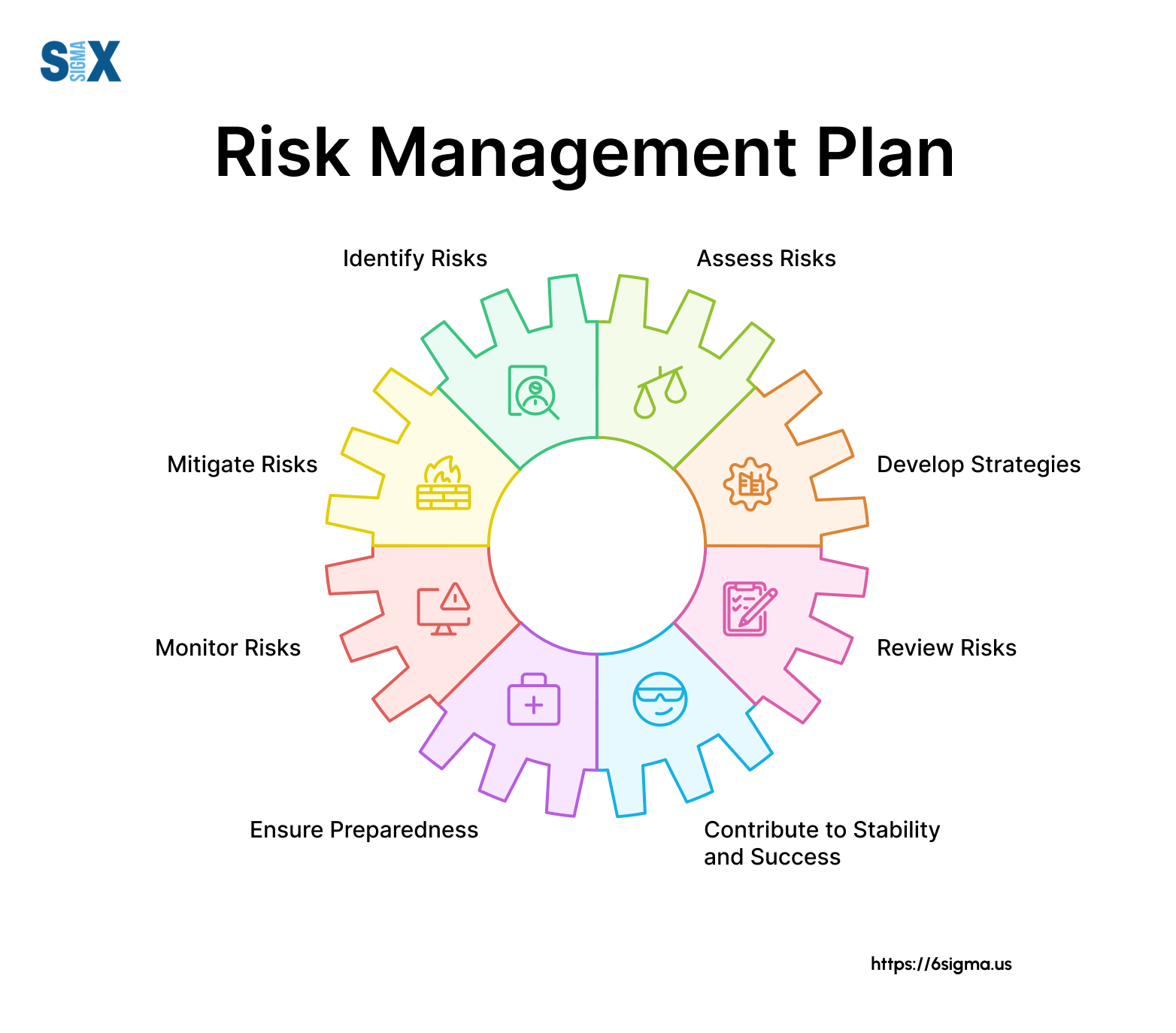

Risk Management, the foundation of numerous industries, pivots on the recognition, examination, and reduction of unpredictabilities in a business environment. By properly identifying potential threats, organizations can create techniques to either stop these dangers from happening or reduce their effect. When risks have actually been recognized and examined, the mitigation procedure involves designing approaches to decrease their possible influence.

Advantages of Executing Risk Management in Business Procedures

Introducing the Duty of Risk Management in Different Industries

While every sector faces its unique collection of dangers, the execution of Risk Management strategies continues to be a common measure in their search of sustainability and growth. In the health care sector, Risk Management entails making certain individual safety and information protection, while in financing, it entails mitigating financial investment dangers and ensuring regulative conformity (importance of risk management). Construction companies focus on worker security, job delays, and budget overruns. In the innovation market, firms mitigate read review cybersecurity hazards and innovation obsolescence. Eventually, the role of Risk Management across markets is to recognize, evaluate, and minimize risks. It is a crucial component of calculated preparation, making it possible for companies to shield their assets, make the most of opportunities, and achieve their objectives.

Real-life Situation Researches Showing Effective Risk Management

To comprehend the value of Risk Management in these lots of markets, one can want to a number of real-life instances that illustrate the successful application of these steps. In the power market, British Petroleum established Risk mitigation intends post the 2010 Gulf of Mexico oil spill. They applied far better safety and security treatments and stricter regulations which dramatically minimized further crashes. In a look at this website similar way, in money, Goldman Sachs effectively navigated the 2008 financial crisis by recognizing possible mortgage-backed safeties threats early. Toyota, upload the 2011 quake in Japan, changed its supply chain Management to lessen disruption threats. These situations show just how markets, finding out from dilemmas, effectively this post used Risk Management approaches to decrease future risks.

Future Trends and Advancements in Risk Management Strategies

Cybersecurity, when a peripheral concern, has catapulted to the forefront of Risk Management, with strategies focusing on reaction, prevention, and discovery. The combination of ESG (Environmental, Social, Administration) aspects into Risk Management is another expanding pattern, showing the increasing acknowledgment of the role that environmental and social threats play in business sustainability. Hence, the future of Risk Management exists in the blend of innovative technology, cutting-edge methods, and a holistic technique.

Conclusion

In conclusion, comprehending the significance of Risk Management throughout a range of markets is crucial for their durability and prosperity. Ultimately, effective Risk Management contributes to more resistant and sustainable businesses, highlighting the relevance of this method in today's dynamic and highly affordable business setting.

While every sector challenges its one-of-a-kind collection of risks, the application of Risk Management strategies stays a common denominator in their search of sustainability and growth. In the healthcare sector, Risk Management entails making sure individual security and data security, while in finance, it includes mitigating investment threats and making certain regulative compliance. Ultimately, the role of Risk Management across markets is to determine, assess, and minimize threats. These instances demonstrate how sectors, finding out from dilemmas, successfully applied Risk Management approaches to decrease future risks.